colorado springs auto sales tax rate

This is the total of state county and city sales tax. The current total local sales tax rate in Colorado Springs CO is 8200.

What Expenses Can I Claim Free Printable Checklist Of 100 Tax Deductions Tax Deductions Printable Checklist Free Printables

Just enter the five-digit zip code of the location in.

. Colorado Springs CO Sales Tax Rate. The maximum tax that can be owed is 525 dollars. The vehicle is principally operated and maintained in Colorado Springs.

In addition to taxes car purchases in Colorado may be subject to other fees like. Colorado State Sales Tax. The 2018 United States Supreme Court decision in South Dakota v.

You can print a 82 sales tax table here. Englewood CO Sales Tax Rate. Average Local State Sales Tax.

Colorado collects a 29 state sales tax rate on the purchase of all vehicles. The Colorado Springs sales tax rate is. What is Colorado Springs Colorado sales tax.

On November 3 2015 Colorado Springs voters approved a sales and use tax rate increase of 062 to fund road repair maintenance and improvements. How to Calculate Colorado Sales Tax on a Car. Colorado Springs in Colorado has a tax rate of 825 for 2022 this includes the Colorado Sales Tax Rate of 29 and Local Sales Tax Rates in Colorado Springs totaling 535.

The average cumulative sales tax rate in Colorado Springs Colorado is 724. Vehicles do not need to be operated in order to be assessed this tax. For tax rates in other cities see Colorado sales taxes by city and county.

Ownership tax is in lieu of personal property tax. Rates include state county and city taxes. Colorado springs vehicle sales tax rate.

Denver CO Sales Tax Rate. Ad Find Out Sales Tax Rates For Free. You can print a 82 sales tax table here.

Within Colorado Springs there are around 51 zip codes with the most populous zip code being 80918. When purchasing a new car the individual p roperly paid city sales tax to the dealer and registered h. Maximum Possible Sales Tax.

The Colorado sales tax rate is currently. For those who file sales taxes. The 82 sales tax rate in Colorado Springs consists of 29 Colorado state sales tax 123 El Paso County sales tax 307 Colorado Springs tax and 1 Special tax.

Colorado Springs is located within El Paso County Colorado. This includes the rates on the state county city and special levels. A Colorado Springs resident owns a home in the C ity and a ranch in the mountains.

The minimum combined 2022 sales tax rate for Colorado Springs Colorado is. The Sales Tax Return DR 0100 changed for the 2020 tax year and subsequent periods. You can find more tax rates and allowances for Colorado Springs and Colorado in the 2022 Colorado Tax Tables.

2020 rates included for use while preparing your income tax deduction. The latest sales tax rates for cities in Colorado CO state. The County sales tax rate is.

Multiply the vehicle price after trade-ins but before incentives by the sales tax fee. The Colorado Springs Colorado sales tax is 825 consisting of 290 Colorado state sales tax and 535 Colorado Springs local sales taxesThe local sales tax consists of a 123 county sales tax a 312 city sales tax and a 100 special district sales tax used to fund transportation districts local attractions etc. The El Paso County sales tax rate is.

The minimum combined 2022 sales tax rate for Colorado Springs Colorado is. Maximum Local Sales Tax. 2021 the City of Colorado Springs sales and use tax rate has decreased from 312 to 307 for all transactions occurring on or after that date.

Depending on the zipcode the sales tax rate of Colorado Springs may vary from 29 to 825. Motorcycle 490 Motorcycle 1300. However a county tax of up to 5 and a city or local tax of up to 8 can also be applicable in addition to the state sales tax.

The Colorado sales tax rate is 29 the sales tax rates in cities may differ from 325 to 104. This is the total of state and county sales tax rates. The Colorado state sales tax rate is currently.

In addition to taxes car purchases in Colorado may be subject to other fees like. Filing Your Tax Return Don T Forget These Credits Deductions National Globalnews Ca Business Tax Small Business Tax Business Tax Deductions The Colorado sales tax Service Fee rate also known as Vendors Fee is 00400 40 with a Cap of 100000. The average sales tax rate in Colorado is 6078.

The 82 sales tax rate in Colorado Springs consists of 29 Colorado state sales tax 123 El Paso County sales tax 307 Colorado Springs tax and 1 Special tax. Method to calculate Colorado Springs sales tax in 2021. What is the sales tax rate in El Paso County.

Colorado Springs Sales Tax Rates for 2022. The December 2020 total local sales tax rate was 8250. This downloadable spreadsheet combines the information in the DR 1002 sales and use tax rates document and information in the DR 0800 local jurisdiction codes for sales tax filing in one lookup tool.

DR 0800 - Use the DR 0800 to look up local jurisdiction codes. The ownership tax rate is assessed on the original taxable value and year of service. This is the total of state county and city sales tax rates.

Fast Easy Tax Solutions. Did South Dakota v. The Colorado Springs Sales Tax is collected by the merchant.

5 rows The 82 sales tax rate in Colorado Springs consists of 29 Colorado state sales. The Colorado Springs sales tax rate is. If your business is located in a self-collected jurisdiction you must apply for a.

Commerce City CO Sales Tax Rate. Colorado springs vehicle sales tax rate. What is the sales tax rate in Colorado Springs Colorado.

The minimum combined 2022 sales tax rate for El Paso County Colorado is. The Colorado Springs Colorado general sales tax rate is 29. Vehicle Fee Vehicle Fee.

Colorado Springs Colorado Sales Tax Rate 2021 The 82 sales tax rate in Colorado Springs consists of 29 Colorado state sales tax 123 El Paso County sales tax 307 Colorado Springs tax and 1 Special tax. The 82 sales tax rate in Colorado Springs consists of 29 Colorado state sales tax 123 El Paso County sales tax 307 Colorado Springs tax and 1 Special tax. The following table is intended to provide basic information regarding the collection of sales and use tax and reflects rates currently in effect.

As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. This is true for Kias and Ferraris and everything in between. Please note that special sales tax laws max exist for the sale of cars and vehicles services or other types of transaction.

Owners may be subject to a different tax rate if the vehicle was purchased within the entity where they reside Fountain Manitou Springs or Monument. For years five through nine the rate is 45 percent. Motor vehicle dealerships should review the DR 0100 Changes for Dealerships document in addition to the information on the DR0100 Changes web page.

To calculate the sales tax on your vehicle find the total sales tax fee for the city. The spreadsheet includes local option exemptions for state-collected. The combined amount is 820 broken out as follows.

The minimum is 29. After that the tax is fixed at 3. Location Tax Rates and Filing Codes.

How 2018 Sales taxes are calculated in Colorado Springs.

Are You Looking For New Tax Deductions On This Years Us Federal Income Taxes Let Your Rv Help You Save More Money On Your Taxes Fin Tax Deductions Rv Rv Life

Irs Tax Forms Infographic Tax Relief Center Irs Tax Forms Irs Taxes Tax Forms

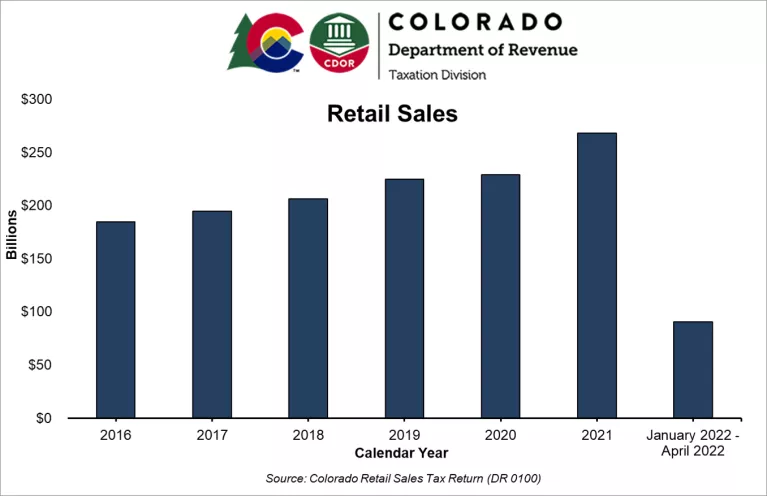

Sales Reports Department Of Revenue

Infographic How To Spend Your Income Tax Refund Wisely Tax Refund Tax Return Tax Help

Track These 5 Tax Deductible Items All Year Pocket Of Money Llc Tax Deductions Business Tax Deductions Small Business Tax Deductions

Income Tax Prep Checklist Free Printable Checklist

5 Dealer Options To Skip When Buying A Car Bankrate

Used Trucks For Sale 4x4 S And Awd Vehicles Mccloskey Motors In Colorado Springs Https Youtube Com Watch Trucks For Sale Used Trucks Used Trucks For Sale

This Is What You Need To Know The First Year You File Business Taxes

Fairytaxmother Com Nbspfairytaxmother Resources And Information Small Business Tax Deductions Business Tax Deductions Tax Deductions

Bugatti Chiron Car Poster Car Art Print Hypercar Etsy In 2022 Bugatti Chiron Bugatti Car Posters

Sales Use Tax Department Of Revenue Taxation

What Colorado Vehicle Registration Taxes Can I Deduct From My Income Tax Sapling

Health Insurance Tax Health Insurance Infographic Infographic Health Health Care

How To Pay No Tax On Your Investments Millennial Revolution

Watson Tax Help Tax Prep Small Business Tax

7745 Pine Oaks Ln Colorado Springs Co 80926 Home For Sale And Real Estate Listing Realtor Com Colorado Springs Colorado Real Estate Listings